Can Intel recover? Gelsinger’s exit sparks speculation and uncertainty

Can Intel recover? Gelsinger’s exit sparks speculation and uncertainty

In a volatile chip market, Intel’s survival hinges on finding the right leadership fast.

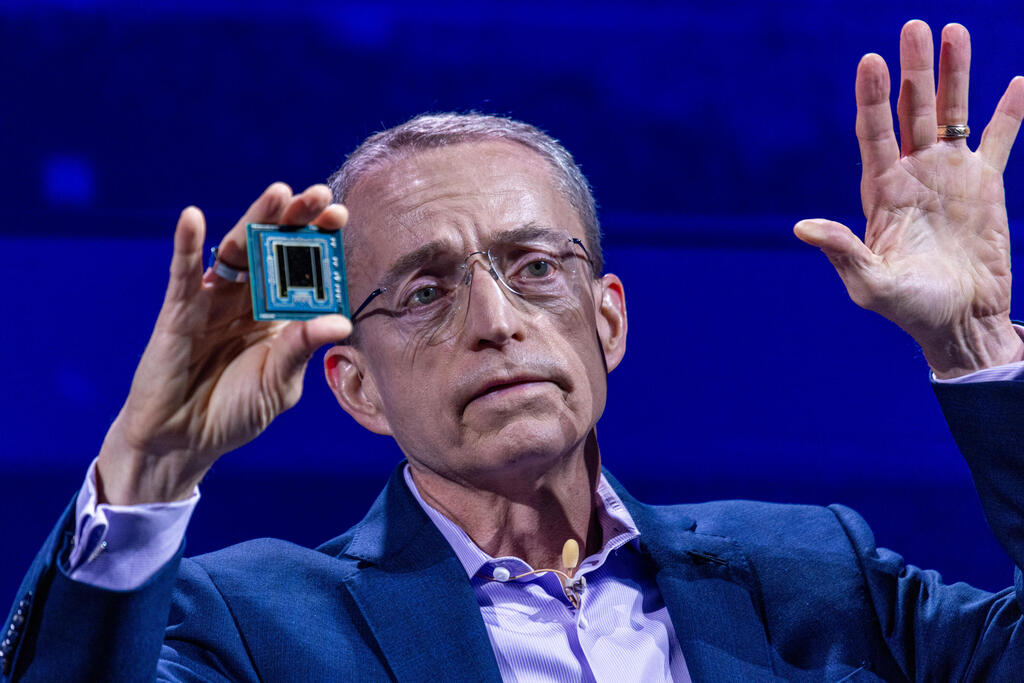

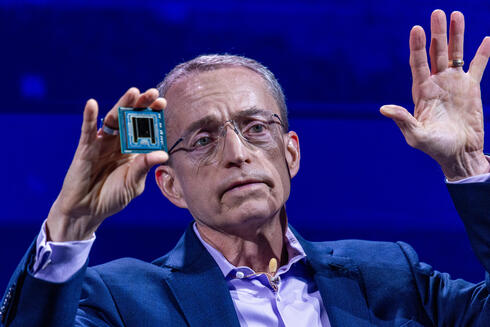

After four years, tens of thousands of employee layoffs, a 60% plunge in the stock price, and the loss of its long-standing spot in the prestigious Dow Jones Index, Intel's CEO is going home. Pat Gelsinger, who received an astronomical compensation package of $178.5 million upon taking office in early 2021—most of it in shares—will not remain on the company's board of directors nor serve as an advisor. Intel's announcement on Monday that Gelsinger is no longer the CEO as of December 1 underscores the depth of the rift and lack of trust between the person once hailed as Intel's savior and the board of directors.

Things, it seems, did not end well. Recently, individuals who met Gelsinger (63) described him as increasingly self-perceived as a messiah rather than a savior. He was reportedly withdrawn and inattentive to his surroundings. The board of directors of what was once a chip giant felt that Gelsinger had lost touch—this during a historic drama as Intel became a potential takeover target and the focus of activist investors. In recent months, since the catastrophic financial report in August that revealed a revenue decline and a loss exceeding $1 billion, rumors of entities interested in acquiring Intel, in whole or part, surfaced regularly.

The most serious contender until recently was Qualcomm, once a minor competitor to Intel but now a stronger player, valued at $180 billion—nearly double that of its longtime rival. If the merger had gone through, it would have created a giant American chip company capable of competing with Taiwanese manufacturers. However, a week ago, Qualcomm signaled it was backing out. Gelsinger's departure, combined with the potential return of Donald Trump to the White House, may revive the merger talks in the coming months.

Another contentious issue was the proposed split of Intel into two companies. Today, Intel remains the only major player that both designs and manufactures chips. For example, Nvidia does not manufacture its own chips, while TSMC solely manufactures chips for others. Recent years have demonstrated a lack of real synergy between design and manufacturing, raising questions about the viability of Intel's current structure.

Although Intel's stock reacted sharply to the news of Gelsinger's departure even before Wall Street trading began, it is uncertain whether this is positive news for the company. During his tenure, Gelsinger not only failed to revive Intel but also seemingly exacerbated its troubles. The semiconductor industry’s cyclical nature and the long timelines for structural changes complicate any turnaround. It is possible that in a year or two, when Intel's new chip factories are operational and market conditions improve, the company might reap the benefits of Gelsinger's efforts. However, for now, Intel remains far from recovery. Last quarter, the company showed signs of stabilization with a positive outlook for the final quarter but reported losses of nearly $17 billion, largely due to write-offs and a 15% global workforce reduction. These layoffs are projected to save approximately $10 billion by 2025.

The ongoing U.S.–China trade war, a rare bipartisan issue in today’s divided U.S. political landscape, could play a role in Intel’s recovery. Last week, the U.S. government approved $8 billion in aid for Intel to build new factories in Arizona, Ohio, and New Mexico, with plans for additional capital injections. However, Intel faces intense competition from rivals making significant technological advances, while it has missed pivotal opportunities in AI, echoing its earlier failure in mobile technology.

Intel’s recovery is crucial for the Israeli economy. As the largest private employer in Israel, Intel retains 10,000 employees, even after recent layoffs and voluntary retirements. Mobileye, in which Intel holds a majority stake, employs an additional 3,000 people, indirectly affecting tens of thousands of workers and contributing to 2% of Israel's GDP and 6% of its high-tech exports. Gelsinger was seen as pro-Israel, frequently visiting even before his tenure as CEO. One of his major moves—creating a separate chip manufacturing division—hinged on the $5 billion acquisition of the Israeli company Tower Semiconductor, which fell through due to Chinese regulatory objections.

Intel’s footprint in Israel extends beyond any single CEO. However, Gelsinger’s abrupt replacement during significant recovery efforts signals a worsening crisis. Intel remains a key player in Israel, but its future here depends on its global performance and ability to compete effectively.

Intel’s new CEO faces the dual challenge of navigating an evolving industry and addressing Intel's internal shortcomings. Despite its legacy, Intel’s market value—now $106 billion—no longer places it among tech giants, trailing companies like Cisco, IBM, and Oracle. Intel’s processes, shaped by its 1968 founding, are slow and cumbersome, hampering its ability to compete with younger, more agile companies.

Gelsinger's departure leaves Intel leaner but still relatively bloated in terms of workforce size. The company’s organizational culture remains unchanged, demanding a shift toward agility and innovation. On the positive side, Intel is now more focused on three areas: chip manufacturing, computing products, and artificial intelligence. While Intel is far from rivaling Nvidia in AI, recent developments suggest the gap may be narrowing.

Intel's ability to find the right leadership quickly is paramount. Interim leadership by CFO David Zinsner, division head Michelle Johnston Holthaus, and chairman Frankie Yeary signals an urgent need for stability. Intel’s history of short CEO tenures—Gelsinger’s four-year term follows two brief predecessors—highlights the instability at the top.

The right CEO could harness Intel’s assets, including its expertise, personnel, and global manufacturing footprint, to chart a new path. While the challenges are steep, Intel's strategic importance to the U.S. and global economies leaves room for optimism, even if the company can no longer compete head-to-head with giants like Nvidia.