Interview

Got milk? Remilk founder: "In this climate crisis, the dairy industry has no right to exist"

Israeli startup Remilk will soon join forces with local dairy company Tara to bring dairy products to the shelves that are not produced from animals. Founder Aviv Wolff shares why he chose to go with the dairy companies and not against them

The Jewish holiday of Shavuot, with its popular custom to consume dairy dishes, has become linked with marketing the local dairy industry in Israel, reflected in the packing of supermarket shelves with special offers and festive launches. However, local products that seek to challenge the industry will soon land in Israel’s supermarkets: dairy products without the use of animals. These include the products of Remilk, a startup that was established in 2019 and last April received its first approval from the Ministry of Health to market its products to consumers.

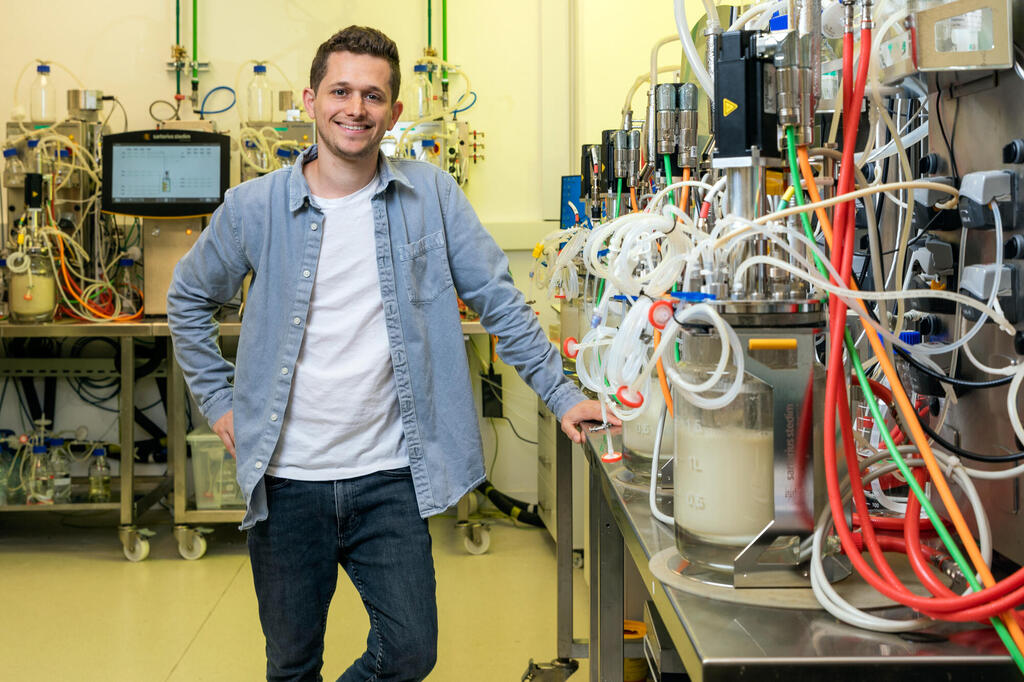

The founder, Aviv Wolff, is responsible for developing cow's milk protein in the laboratory without the use of animals. The initial products that will be released to the public will be part of a partnership between Remilk and Tara, Israel's leading privately owned manufacturer of dairy products, and in the coming years the protein will be sold as a raw material to manufacturers in Israel and around the world.

So what does Remilk have to offer the crowded market shelves of milk, cheese and yogurt? The process Remilk uses is called fermentation. The company copies the segment of DNA required to produce cow's milk proteins, inserts it into yeast and thus turns it into a "factory" that produces the same protein found in animals. Remilk will then market this protein powder to various factories.

"We produce milk protein that is 100% identical to cow's protein. The cow has a 'recipe' and preparation instructions for all the components it needs in milk. We copy this recipe in the laboratory and put it into an efficient microorganism (yeast) that rapidly grows only what we need: a functional substance that becomes a building block of various dairy products only without lactose, cholesterol, growth hormones and antibiotics, and without harming the environment and animals."

The raw material will be delivered directly by Remilk to factories that currently produce dairy products. Israel, as mentioned, will be the first to use them. "The launch of products involves vigorous work. The common vision is to present the consumer with a wide variety of products, not just one product. Our process is a scalable, proven, industrial production at a competitive price for the dairy industry. We are not stuck in a fantasy of selling a substitute that costs hundreds of shekels."

Remilk is the first company engaged in fermentation to receive regulatory approval in Israel. "The industry thought that the Ministry of Health's approval process would take more time," says Wolff. "This is a new food, not another plant-based substitute with unique processing. There are processes similar to this in the food industry, but the Ministry of Health's claim is that the percentage of use of the protein in the final product is high compared to the products on the market, and therefore it requires approval as a new food. Our claim was that the relative portion is not really a factor because it's the same protein, exactly the protein you consume in dairy products. Today almost 90% of all cheeses have an enzyme that is produced by microbial fermentation in a process of genetic engineering. It's clear that this is a healthy and safe food. Our protein is a known protein that has been consumed by humans for thousands of years."

At this stage, you mainly deal with "soft" products. In the substitutes market there is actually a significant lack of hard cheeses, and this is also the biggest technological challenge in the sector: the protein may break down in cheese that is aged over time.

"There are two main groups of proteins in animal milk: casein, which makes up 20% of the cow's proteins, and the group of whey proteins, which make up 80% of the cow's milk proteins. Today we produce on an industrial scale the whey proteins, the main protein in cow's milk, which is particularly relevant to the world of ice creams, yogurt, milk, and soft cheeses. The world of casein proteins is particularly relevant to the world of hard cheeses. We produce both, but the protein we are commercializing first is whey. Regarding casein, we will get to that too."

Despite there being quite a few substitutes for the soft products: yogurt, milk, and cheese, the category has not grown to the dimensions that threaten the traditional milk market. Is there really one substitute that can beat the market?

"It is clear to us that this is an industry that is going to change and that there is a huge business opportunity here because of the environmental, financial and consumer story. On the environmental side, in order to avoid an environmental catastrophe, the food industry needs to drastically reduce its greenhouse gas emissions. The dairy industry has no way to do this and that means that in the long run, in an era of climate crisis, it has no right to exist. The only way is transformation. Our technology can save 95% of emissions. The dairy industry will never reach these numbers.

"The second point is financial. The dairy industry is struggling to survive. 50% of an American dairy farmer's income comes from government subsidies. This number will have to grow dramatically in the coming decades as in the past two decades more than half of the dairy farms in the U.S. closed due to financial pressure. The profit margins are very low. This is the most central factor that will help us take market shares from the traditional industry: we will remove the economic interest from building a dairy farm and milking cows. We also see that consumer preferences are changing, especially among the younger generations. There is a sharp decrease in the desire of the young to consume animal products and specifically milk. In the natural cycle of life, the expectation is for the sector to grow and the consumption of animal milk to decrease."

Wolff's reluctance to label products as niche for vegans or environmentalists is backed up by experience gained around the world in the field. According to the consulting firm BCG, only 5% of U.S. consumers consider themselves vegan or vegetarian. In fact, behavioral science research shows that prominently displaying a "vegan" label can create a psychological barrier for consumers, who may think the product is not for them.

Additionally, when making decisions about food, only 20% of mainstream consumers base their purchasing decisions on sustainability, even though 60% of them are concerned about the issue. That's why more and more companies today place an emphasis not on the moral values of the product, but on considerations such as taste, health and price. "The branding is a huge challenge that we are working on," says Wolff. "We don't want people to think that this is another 'substitute' that needs to be compromised, but it should be clear that we are not animal milk. It is a product that is neither this nor that. This is a marketing challenge: to establish a new category that is in between."

Many investors treat cows as the new coal: they fuel a polluting industry that leads to unprecedented damages. If they were a country, it would be the world's third largest emitter of greenhouse gasses, with animal agriculture alone responsible for about 15% of global emissions. Population growth is expected to worsen the situation. That is why many investors flocked in recent years to add protein companies to their portfolio, which are considered one of the most effective investments for climate impact.

Over the past decade, the alternative protein sector has attracted private capital of $14.2 billion, with annual investments nearly doubling every year on average. The era of cheap money came to an end in 2022 and the foodtech sector also suffered. According to the Global GFI report, alternative protein companies raised $2.9 billion worldwide in 2022, a 42% year-over-year decrease. In Israel, there was a 35% decrease in investment amounts, compared to a 40% decrease in Israeli high-tech in general.

Remilk, established in 2019, is part of the large investment wave in the field. It has raised approximately $150 million, an amount considered significant in the Israeli and global foodtech industry. The company enjoys the trust of investors such as Precision Capital, Hanaco Ventures and OurCrowd, but not only these. Tnuva and the Central Beverage Company, two local milk giants, are also investing in it. In a challenging period in the markets, where the high-tech industry is shrinking, Wolff's foodtech startup has a long runway.

According to the Start-Up Nation Policy Institute, nine Israeli startups in the field of alternative milk have raised money in recent years. In 2022, three companies that produce alternative milk proteins raised a total of $158 million (Remilk, Imagindairy and Chickpea), a fourfold jump compared to 2021, in which a sum of $33.5 million was raised by three companies.

According to Danny Biran, a senior policy fellow at the institute, the growing industry in Israel can become a significant engine of economic growth that does not focus only on 8200 graduates. "This growth is important for the Israeli economy as a whole and for local employment, since it is a sector that is not software-biased, which allows the entry of diverse populations into high-tech and a wider geographical spread," Biran said.

The current challenging economic environment has not bypassed even the strongest companies in the field. Remilk's collaboration with the American food giant General Mills in the production of cream cheese was terminated in January shortly after it began. The company examined its innovation portfolio and decided to reduce the priority for financing the cheese brand, which before Remilk contained the proteins of the American company Perfect Day.

According to market estimates, the global economic slowdown also caused General Mills to tighten its belt. One of the reasons for this may be that sales of alternative cheese in the U.S., a niche category, shrank in 2022 compared to growth in the substitutes market.

Why go for collaborations with the traditional dairy companies if you want to replace them?

"Our strategy is to team up with food companies. The go-to-market challenge in the food industry is enormous, and we want to use existing food giants to enter the market. So the question arises regarding companies with animal products.

"There is a certain kind of cannibalism here in that companies launch such products, but we understand that the profit margins in the dairy industry are shrinking to the point where there are categories in the U.S. and Israel that are on the verge of becoming unprofitable, such as the liquid milk category. We believe in the traditional dairy industry's ability to change. We want to be the catalyst that enables this change."

You decided to market raw materials to companies rather than launch products yourself, but the raw material suppliers usually disappear. No one is interested in Tnuva's soy supplier.

"The marketing challenge of getting the consumer to take the product off the shelf is something we want to do with partners who have decades of experience in the market. Reaching every supermarket in the State of Israel or the USA with 3-4 categories and a $100 million marketing campaign is something that can be done faster with large established companies."

At the end of 2022, you were supposed to set up your own huge factory in Denmark, which is considered the world capital of fermentation technologies. You have decided to freeze this program for now.

"We have found an excellent partner to cooperate with, one of the largest factories in the world that is already producing on an industrial scale in Western Europe. This is a great achievement and it speeds up our timetables for entering the markets. They fill the gaps for us for the next few years because they have the most significant scale-up capability in the world."

First published: 09:00, 26.05.23